The Nebraska Investment Council determines the investments for the State Employees Retirement System of the State of Nebraska and the Retirement System for Nebraska Counties, and the State Deferred Compensation Plan.

Cash Balance Benefit

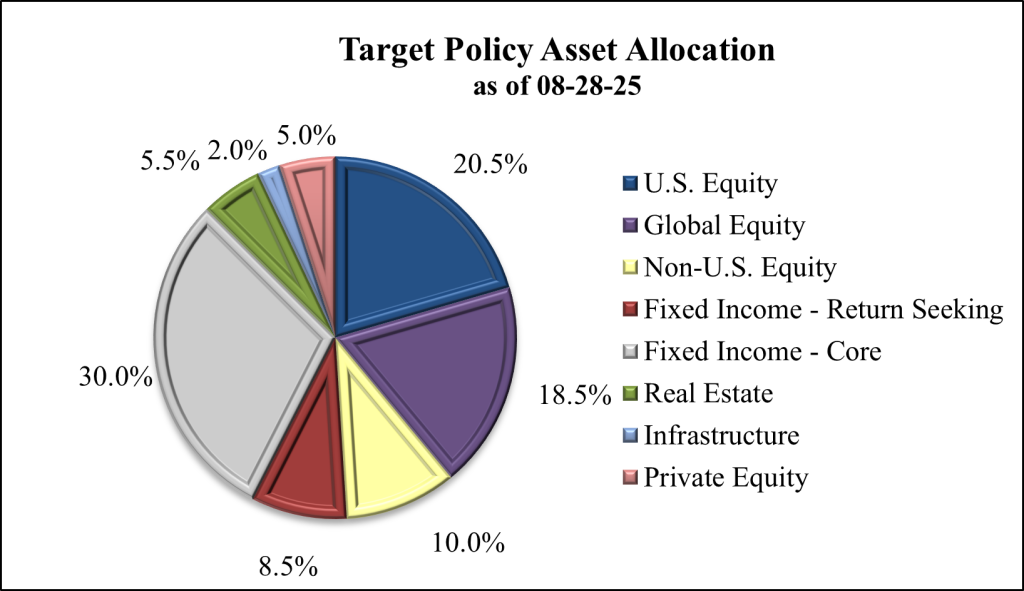

Since January 2003, the accounts for all new employees who participate in the State and County Retirement System Plans are automatically invested in the Cash Balance Benefit. Members who participate in the Cash Balance Benefit do not make their own investment choices. The assets are held in a trust fund which is managed by the Nebraska Investment Council. Cash Balance Benefit participants are guaranteed an annual interest credit rate which is defined in statute as the greater of 5% or the federal mid-term rate plus 1.5%. The interest credit rate is adjusted each calendar quarter.

Defined Contribution

Prior to 2002, employees in the State and County Retirement System Plans were only offered the Defined Contribution. In December 2002 participants were given the option to remain in the Defined Contribution or transfer to the Cash Balance Benefit implemented in January 2003. Also, in 2007 and 2012, participants could elect to transfer to the Cash Balance Benefit.

Members who remain in the Defined Contribution make their own investment choices based on the funds offered. Contributions to these accounts come from both the employee and the employer. With the passage of LB 366, State employees are required to contribute 4.8% of their salary (beginning January 2007). The State matches the employee contribution at the rate of 156%. County employees are required to contribute 4.5% of their salary. The county matches the employee contribution at the rate of 150%. The account balance for both state and county employees consists of accumulated contributions plus investment gains or losses. For more detail on the Plans, the Investment Report can be found on the Nebraska Public Employees Retirement System's website click here.

Investment Choices

U.S. Equities

U.S. Total Stock Market Index Fund

Non U.S. Equities

International Stock Index Fund

Global Equities

Global Equity Fund (RGGIX)

Fixed Income

Stable Value Fund

U.S. Bond Index Fund

U.S. Core Plus Bond Fund (PTTRX)

Premixed Funds

Investor Select Fund

Target Date Funds

LifePath Index 2070 Fund

LifePath Index 2065 Fund

LifePath Index 2060 Fund

LifePath Index 2055 Fund

LifePath Index 2050 Fund

LifePath Index 2045 Fund

LifePath Index 2040 Fund

LifePath Index 2035 Fund

LifePath Index 2030 Fund

LifePath Index Retirement Fund

State Deferred Compensation Plan

The voluntary Deferred Compensation Plan for State employees offers the same investments as those offered in the State and County Retirement Systems’ Defined Contribution. Combining the investment of the State Deferred Compensation Plan and the much larger State and County Defined Contribution provides a major reduction in costs for participants making voluntary contributions. For more detail on the Plans, the Investment Report can be found on the Nebraska Public Employees Retirement System's website click here.

U.S. Equities

U.S. Total Stock Market Index Fund

Non U.S. Equities

International Stock Index Fund

Global Equities

Global Equity Fund (RGGIX)

Fixed Income

Stable Value Fund

U.S. Bond Index Fund

U.S. Core Plus Bond Fund (PTTRX)

Premixed Funds

Investor Select Fund

Target Date Funds

LifePath Index 2070 Fund

LifePath Index 2065 Fund

LifePath Index 2060 Fund

LifePath Index 2055 Fund

LifePath Index 2050 Fund

LifePath Index 2045 Fund

LifePath Index 2040 Fund

LifePath Index 2035 Fund

LifePath Index 2030 Fund

LifePath Index Retirement Fund